Due Diligence for Growth

More than $15 million in annual operational savings.

Case Studies

Business Issue

A private equity firm asked Flow Consulting for an assessment and a project plan with payback for improving performance in areas identified for improvement. Flow Consulting performed an operations assessment for a private equity client last year at a manufacturer supplying key components for the trucking and fire truck industry.

Approach Used

During the assessment phase, Flow Consulting determined that there was an opportunity to improve labor productivity by as much as 50 percent across the entire plant — if the client implemented the key aspects of LeanSigma manufacturing.

Additionally, Flow consultants identified significant opportunities to improve the manufacturer’s purchasing processes. Flow Consulting also provided the private equity firm with a one-year intervention plan to help the client realize the number of opportunities for improvement available to them.

The report provided to the leadership of the private equity firm was very well received. To request a “scrubbed-to-protect-the-innocent” version of the report, e-mail reesebourgeois@flowconsulting.com.

Results

After the acquisition, the private equity firm and the new CEO of the acquisition immediately engaged Flow Consulting to:

Implement LeanSigma manufacturing in the highest volume product line, and

Develop procurement strategies and improve cash-flow in the procurement arena.

Meanwhile, the CEO focused on developing relationships with key customers and improving the sales of the firm, knowing that Flow Consulting was focused on the internal aspects of supplying product to customers.

Several Flow consultants worked with the operations team to collect the appropriate data and then facilitated a lean manufacturing kaizen in the highest volume product line.

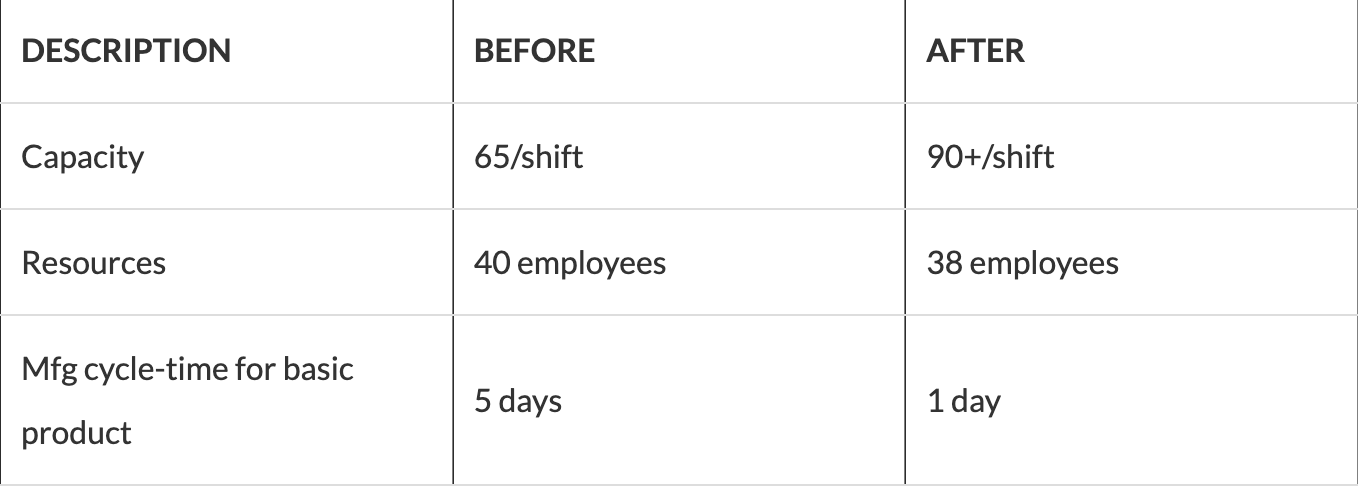

The kaizen produced the following results:

In addition to these results, the kaizen resulted in a checklist of more than 100 action items to continually drive improved flow, improved quality and better control of incoming materials. The production process improved so dramatically that the operators are able to occasionally take one-hour at the end of the shift to address these open action-items as a team, resulting in continued improvements.

Flow consultants worked with the Purchasing Manager and CFO to begin implementing Best Practices for Lean Procurement, with the following results:

Replenishment Times were obtained to better estimate inventory needs (kanbans)

AP balance moved from 7-days to 30-days ($600k improvement): with goals of reaching 45 then 60 days.

Detailed commodity plans were created with Engineering and Procurement to ensure that all employees understood the strategy for each vendor.

Based on the above success, Flow Consulting has been engaged to drive similar operational improvements for another product line while simultaneously transferring LeanSigma skills to key employees.

Competing Companies Combined

Business Issue

Two separate private equity firms jointly employed Flow Consulting to study the potential benefits of combining two companies that each of the two firms owned. The two companies competed in providing sales and installation of a specific component within the housing industry — to protect their identities we will not divulge that component, but combined sales for the two companies exceeded $200 million.

The key questions asked of Flow Consulting:

Could two major facilities be consolidated into one facility using state-of-the-art Lean Manufacturing concepts?

Which IT systems would support the new combined entity best?

What would the operational and purchasing savings be?

Approach Used

Flow consultants worked with both Purchasing teams to determine the opportunity for savings based on volume, different price points obtained at the same suppliers, and an analysis of leveraging existing China-sourcing initiatives to a larger degree.

Flow consultants also focused on applying lean principles working with both Operations Managers to come up with product flows that could be accomplished in the smaller of the two facilities. Thanks in part to extensive past experience in consolidating operations, Flow consultants delivered a detailed cost analysis for moving the larger facility operations to the smaller facility.

Flow consultants dove into the costs of Operational and Purchasing line items in their P&L, including detailed and exact numbers on the amount of manpower supporting all of the numbers. They then modeled these inputs into a financial statement that clearly illustrated the outcomes of the efforts in Purchasing and Operations, along with the costs savings of moving to one facility.

Flow consultants also provided the financial leadership in developing three-year quarterly financial statements (income statement, balance sheet and cash flow), forecasting the impacts of Purchasing and Operations synergies, including the consolidation of facilities.

The Flow Team also led the effort to assess the IT capability of each company and provide recommendations on the future integration of IT systems to support the combined companies in the future.

Results

More than $15 million in annual operational savings were realized in the following categories:

$4 million in purchased products

$4 million in labor as a result of the lean product flows and a reduced labor rate at the smaller facility

$7 million in manufacturing support and distribution costs as a direct result of the lean product flows and reduced inventory