Strategic Sourcing

Service Overview

Integrated Strategic Sourcing is a mix of leveraged sourcing and category management. The combination creates the organization capability for one voice to drive for better results, using cross functional teams, long term written strategies, supplier collaboration, and appropriate negotiating techniques.

Our Strategic Sourcing Consulting focuses on the Total Cost of Ownership (TCO) and not just purchase cost. Getting the best value is more important than the lowest, cheapest cost. By driving a rigorous and collaborative team we can avoid ad hoc beating up suppliers or the tradition ‘three quotes’ approaches. Strategic Sourcing also take the view of a continuous process, not a one time event. We come back again and again and share continuous improvement with our strategic partners.

All sourcing models have the following basic elements:

Identifying and prioritizing the opportunities, target spend categories or commodities

Creating a cross functional sourcing team including representatives from operations, engineering, finance, quality, purchasing and supply chain

Develop a project strategy and communications plan

Gather market intelligence and detailed business requirements

Collect a supplier pool or portfolio

Specify a supplier profile

Document a data package

Conduct a sourcing event, e.g. RFI/RFP, auction

Negotiate, evaluate, award

Supplier Relationship Management: contract, long term agreement, service level agreement, vendor scorecard, periodic governance, and most importantly – continuous improvement

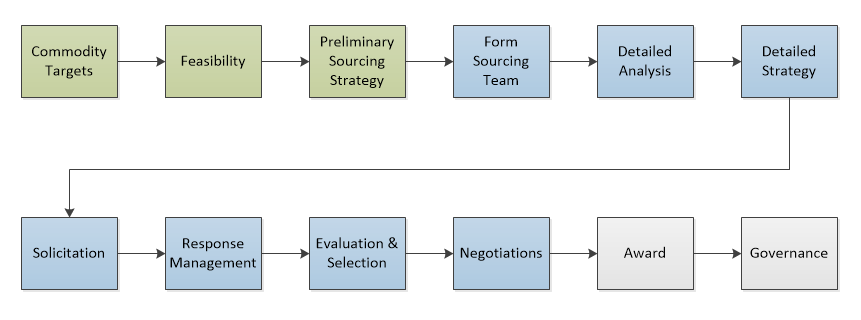

A Road Map For Integrated Strategic Sourcing

1. and 2. Commodity Targets and Feasibility

These about determining spending patterns, cursory market analysis, mapping the use of goods and services. Spend Analysis and defining supplier and commodity groups is the first step. Spend Analysis is the business process of collecting, classifying and analyzing purchase order and accounts payable data to look for opportunities to decrease procurement costs, improve service and operational efficiency, and monitor compliance. It is critical to prioritize the various spend areas.

The steps are simple:

Identify data sources from all areas of the business … accounts payable, general ledger, p Card.

Gather data and summarize. This can be tough if data is in different systems and formats.

Scrub the data for transaction types, descriptions, duplicate products groups and supplier names.

Group suppliers with multiple ship-from or billing addresses.

Categorize similar products or services into commodity families.

Analyze the spend by supplier; drive buyers o purchase from the preferred suppliers to further concentrate the leverage

3. Preliminary Sourcing Strategy

This is usually done in two steps: preliminary and detailed. Initially we need to determine the scope of work, technical specifications, identify stakeholders, identify sourcing challenges, set a rough project timeline, and socialize the opportunity to the rest of the organization. Strategies could include holding a reverse auction, sole sourcing, join venture, technology development agreement, outsourcing, or RFx (information, proposal, quote)

4. Forming a Team

Chartering a team of key stakeholders from all affected areas and disciplines. Get them started by giving them a problem to solve, an approach to take, and clear expectations of time and effort.

5. Detailed Analysis

Detailed Analysis is when we conduct a comprehensive market analysis to identify potential suppliers, industry best practices, new technology. This can include field trips and vendor presentations.

6. Detailed Strategy

This is the second pass at developing the requirements for supplier relationship type, price targets and terms, performance metrics, selection method and criteria, potential vendor list, change management procedures, project schedule and budget, and stakeholder sign off.

7. and 8. Solicitation and Response Management …

‘RFx’ – Request for Proposal/Request for Quote is the formal process of providing information and requirements to the potential suppliers, answering their questions, compiling their responses, organizing the responses in order to make a selection recommendation.

9. Evaluation and Selection

Selecting vendors can often become emotional. Selection criteria and decision making process are best when decided before solicitation and standardized across the organization.

10. Negotiations

With a short list of one or two finalists it may be prudent to further clarify requirements and capabilities, evaluate alternative proposals or value-added services. One area often missed is having an ‘off ramp’ should the relationship unwind; an all to common occurrence when deal are badly conceived and relationships sour.

11. Contract Award

Presenting the findings, project brief, service and cost evaluations, risk management plan, benefits and recommendations to leadership. can be a bit of an art. Having routine standard work, agendas, clear roles always helps. Once stakeholders and leaders sign off comes working with contract management to finalize master services agreements, long term agreements, and other commercial legal documents.

12. Governance: Supplier Relationship Management

The commodity manager has the business responsibility to monitor and actively manage the interactions with the suppliers to assure and maximize the value goods and services. Continuous improvement implies a partnership relationship. Often the buyer’s processes and practices are inefficient and institutionalize waste. Periodic supplier reviews can be an open forum for attacking the ‘white space’ between supplier and buyer.